Real estate syndicates are one of the most efficient and effective investing methods.

By pooling resources with like-minded investors, you can get your foot in the door in some of the best markets and deals.

But real estate syndications can be tricky.

If you don’t know what you’re doing, you might lose money (and your shirt).

This article will walk you through the basics of syndication and give you seven practical tips for getting started without mucking things up.

Let’s start by answering a simple question.

What Is Real Estate Syndication?

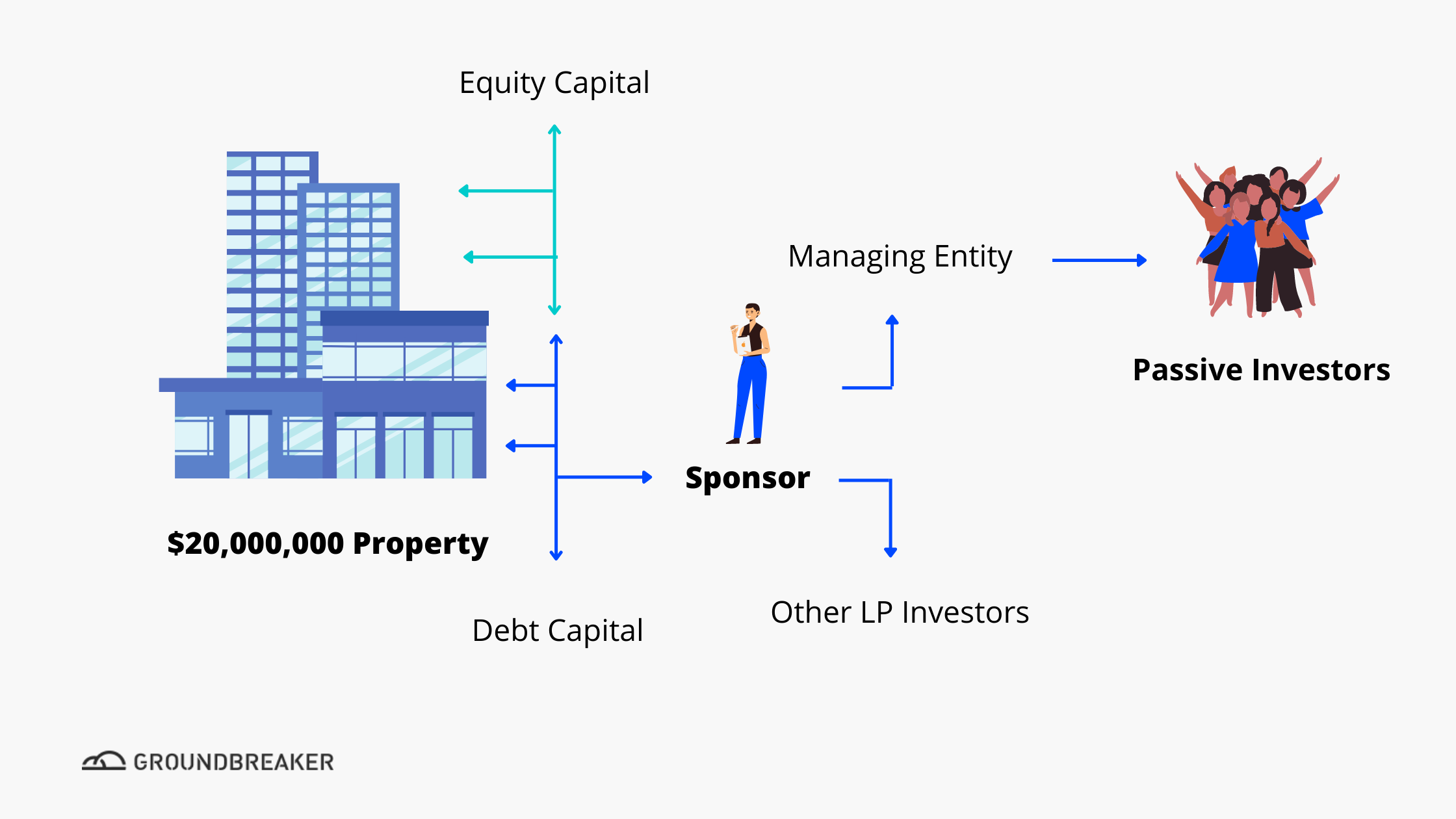

Real estate syndication is the process of pooling funds from multiple investors to finance the purchase of a property (or properties).

The lead investor, or syndicator, is responsible for finding and vetting investment opportunities and managing the property’s day-to-day operations. But they may delegate some responsibilities to third-party professionals.

This structure has several benefits for the investors and the project itself.

Private investors can get involved in a real estate project without the pain of managing a property.

And for the project, it means that experienced professionals handle all of the details and management.

Besides, real estate syndication allows investors to tap into more considerable capital. This can be especially helpful for new investors who may not have the financial wherewithal to go alone.

Some other benefits of real estate syndication include:

Reduced risk: By investing in a syndicate, you spread your risk across multiple properties and real estate investors. This can help protect you from the potential downside of any particular investment.

Increased potential return: Pooling your resources with other investors gives you access to a larger pool of capital, increasing your potential ROI.

Improved diversification: By investing in a syndicate, you can gain exposure to a broader range of properties and markets. This can help improve your portfolio’s diversification and reduce your overall risk.

Ease of entry: Syndication provides a simpler and easier way to start real estate investing, especially if you’re new.

How Do Syndicators Raise Capital (and Make Money)?

A syndicator, in the context of raising capital, is a person or a company that brings together a group of investors, known as a syndicate, to participate in a financial transaction such as a debt or equity offering.

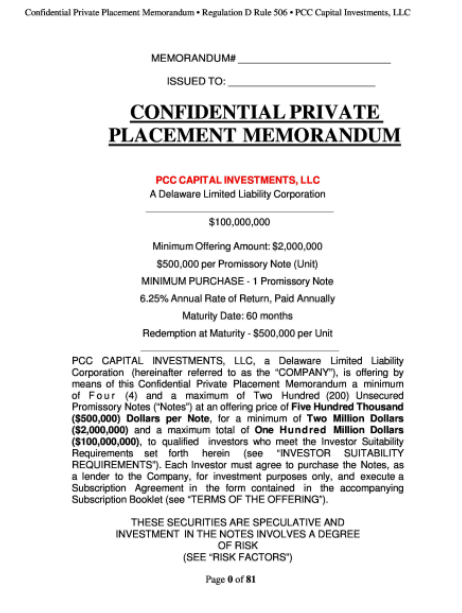

They have many responsibilities: The syndicator acts as the lead investor, or syndicate manager, and is responsible for coordinating the syndicate, identifying and evaluating investment opportunities, preparing a private placement memorandum (PPM), and managing the ongoing relationship with the other members of the syndicate.

(Though we’ll get into it a tiny bit later, a PPM is a legal document that outlines the details of an investment opportunity, including the terms and risks involved. Its role in raising capital is to provide potential investors with the necessary information to make an informed decision about participating in the syndicate.)

The syndicator is responsible for managing the ongoing relationship with the other members of the syndicate, which involves regular communication, providing updates on the investment, addressing any concerns or questions, and ensuring that the syndicate operates in accordance with the agreed-upon terms.

If you, as a syndicator, wish to receive a greater return from a syndication, the easiest way is to take on a larger share of the investment by committing more capital compared to other members of the syndicate. This allows you to have a greater financial stake in the investment and potentially hold more decision-making power within the syndicate.

How Does Investing in a Syndication Work?

Let’s say you want to invest in a multifamily property in New York through syndication.

The first step is to find a reputable and experienced real estate syndicator.

The lead investor is responsible for finding, negotiating, and acquiring the property. They will also manage (or delegate) the operations related to that property.

Once the lead investor finds a property, they’ll build a syndication team. This team typically includes an attorney, accountant, and other professionals experienced in real estate investing.

The lead investor will then create a Private Placement Memorandum (PPM).

The PPM will include all the relevant information about the investment opportunity, including:

- Details about the property

- The syndication team

- The expected return on investment

- The risks involved

Once the PPM is finalized, it will be distributed to potential investors.

If you’re interested in investing, you will complete and sign a subscription agreement. This document outlines your investment amount, rights, and responsibilities as an investor.

Once the real estate deal is finalized, and the syndication team is in place, the lead investor will acquire the property and begin managing it according to the plan laid out in the PPM.

As an investor, you will be entitled to a percentage of the profits (or losses) generated by the property. You will also have the right to inspect the property and review the financial reports related to the investment.

7 Steps to Start Your Own Real Estate Syndicate

Starting a syndicate is a great way to get involved in the industry and begin reaping the benefits of real estate investing.

But it’s not a decision to be taken lightly. You should do a few things before starting.

Let’sLets‘ explore a few of them.

1. Find the Right Property

The first step to starting your own real estate syndicate is to find the right property. This means finding a property that meets your investment criteria and that you believe has the potential to generate a good ROI (Return on Investment).

Some ways to find excellent properties might include:

- Working with a real estate broker: Real estate brokers have access to various properties that might be a good fit for your investment goals.

- Working with a real estate agent: Real estate agents can help you find properties that meet your investment criteria.

- Looking for distressed properties: Properties in foreclosure or otherwise in distress may offer a good opportunity for a syndicate investment.

- Real estate auctions: Auctions can be a great place to find properties that are being sold below market value.

- Searching online: Several websites list investment properties for sale, such as Realtor.com and LoopNet.com.

2. Research the Market

Once you’ve found a property you’re interested in, do your homework and research the market.

Researching the market involves:

- Checking out the local economy

- Understanding the demographics of the potential renters

- Looking at comparable sales in the area

- Studying external forces that might influence the market

- Collecting financial information about potential investment properties

- Sharing your findings with teammates to make a decision

You can better understand whether the property is a good investment by doing your research.

For instance, let’s say you want to invest in a rental property in a small town. Besides looking at comparable sales, you might also want to look at the town’s economic prospects.

If the town is struggling, there may be fewer renters who can afford to pay rent, making it more challenging to generate a profit on your investment.

Also, it’s vital to understand the demographics of potential renters.

If you invest in a student rental property, you must understand the enrollment trends at the local colleges and universities. If the student population is declining, there may be fewer potential renters for your property.

You must also understand the needs and wants of your potential renters.

For instance, if you’re investing in a rental property for families, you’ll want to make sure the property is in a good school district.

Real estate is all about location, so it’s essential to understand the market you’re investing in.

3. Run the Numbers

After you’ve done your market research, it’s time to run the numbers on the property.

This process includes:

- Calculating the potential rental income

- Estimating repair and maintenance costs

- Determining your desired return on investment

- Defining your exit strategy

And any other costs associated with owning and operating the property.

In real estate, math is your best friend.

Don’t rely on your gut to make investment decisions.

Instead, use data and numbers.

It’ll help you make more informed decisions and avoid costly mistakes.

For instance, let’s say you’re considering investing in a rental property that will cost $100,000 to purchase and fix up.

If you think you can rent the property for $1,200 per month and estimate that your monthly expenses will be $600, you can expect to net $600 per month in gross profit.

4. Put Together a Syndicate

Once you’ve found an investment property and done your due diligence, it’s time to find potential investors, negotiate the terms of the investment, and structure the real estate deal.

Some ways to find potential investors include:

- Asking friends and family: If you have friends or family members who might be interested in investing, they can be a great source of capital for your syndicate.

- Real estate investment clubs: There are many real estate investment clubs around the country that you can join. These clubs can be a great way to meet private investors.

- Facebook groups: Facebook groups offer a free and simple way to connect with like-minded people in the industry.

- Working with a real estate syndication platform: Many online platforms connect real estate developers with potential investors. These platforms can be a great way to raise capital for your syndicate.

5. Negotiate the Terms of the Investment

In real estate, there’s always room for negotiation.

You may be able to negotiate a lower purchase price for the property. Or, you may get the seller to pay for some of the repairs and renovations.

Be clear about what you want before you start negotiating. That way, you can stay focused and avoid misunderstandings and conflict down the road.

You must also negotiate with your potential investors to agree on the terms of the investment. This includes how much each individual investor will contribute and what percentage of ownership stake they’ll receive.

6. Structure the Deal

Now it’s time to structure the deal, which involves setting up an LLC or partnership, drafting partnership agreements, and creating investment contracts.

In other words, it’s time to get the legal details in order.

The deal’s structure will vary depending on the type of property you’re investing in and the investment strategy.

For example, if you’re syndicating a fix-and-flip project, an LLC would probably be more convenient. Whereas a partnership would make more sense when buying a buy-and-hold rental property.

Research the different types of legal structures and choose the one that makes the most sense for your syndicate.

Of course, you should always consult with an experienced attorney to make sure you’re setting up the real estate syndication deal correctly.

7. Close the Deal

After you’ve negotiated and structured the deal, it’s time to close it. This includes signing contracts, transferring property ownership, and funding the investment.

Closing a real estate syndication deal can be challenging. You must clearly understand what’s involved before moving forward.

Make sure that all of the necessary documents are in order and that all parties agree.

Also, ensure that the investment property is transferred correctly and that all funds have been disbursed.

You might also consider hiring a lawyer or real estate agent to help you with the process.

Do I Need to Register With the SEC?

Most syndicators don’t need to register with the SEC, even though they’re offering and selling securities. This is because a wide range of exemptions exist.

What Are the SEC Registration Exemptions?

SEC registration exemptions are provisions that allow companies to offer and sell securities without having to register them with the Securities and Exchange Commission (SEC) in the United States. These exemptions provide flexibility to businesses in raising capital while still ensuring compliance with securities laws. Here are some of the most common exemptions:

1. Regulation D: This exemption enables companies to raise capital from investors, both accredited and non-accredited. Under Rule 506(b), companies can raise an unlimited amount of funds from non-accredited investors, while Rule 506(c) allows the solicitation of capital exclusively from accredited investors. By utilizing Regulation D, companies can avoid the lengthy and costly SEC registration process.

2. Regulation A: This exemption permits companies to raise up to $50 million in a 12-month period from any type of investor, without having to register the securities with the SEC. Compared to Regulation D, Regulation A offers a broader scope of potential investors while still providing regulatory relief.

3. Regulation CF: This exemption allows companies to raise up to $5 million from any investor type, but only through a registered crowdfunding portal. Unlike Regulation D, Regulation CF specifically pertains to crowdfunding offerings, enabling small businesses to access capital from a wider investor base.

4. Regulation S: This exemption is applicable to securities offered and sold outside the United States. It can be utilized by both domestic and foreign issuers when conducting offerings exclusively outside of the country.

5. Section 4(a)(2) of the Securities Act of 1933: Commonly known as the private placement exemption, this provision allows companies to privately sell securities to a limited number of investors without undergoing SEC registration. It is often utilized for investments targeted at sophisticated investors.

6. Rule 504 of Regulation D: Companies can raise up to $5 million in a 12-month period from any type of investor under this exemption, without SEC registration. Rule 504 provides companies with an option to access capital without the stringent requirements of other exemptions.

7. Rule 147A (amended Rule 147): This exemption is designed for intrastate offerings, meaning securities are offered and sold solely within a specific state. Rule 147A offers greater flexibility compared to its predecessor, Rule 147, by allowing limited offers to out-of-state residents.

It is important to note that although these exemptions allow companies to bypass SEC registration, they are still required to comply with other securities laws, such as anti-fraud provisions. Additionally, while the term “registration” might not be necessary, companies often need to make filings with the SEC to remain in compliance with applicable regulations.

How to Make Informed Decisions About Your Syndication

To make an informed decision, you first need to be…well, informed. Read below for some frequently asked questions about syndications. While many of these are framed from a passive investor side, understanding your investors’ needs is absolutely essential in running a successful syndication. So: Let’s not shy away from stepping into their shoes for a moment.

What Rights Do Investors Have in a Syndication?

Investors in a syndication typically have certain rights. They are entitled to a percentage of the profits (or losses) generated by the property, in proportion to their investment. Investors also have the right to inspect the property and review the financial reports related to the investment on a regular basis. They should have access to information about the property’s performance, updates on any significant events or changes, and clear communication from the syndicator regarding the project’s management. It is important for investors to understand their rights and ensure they are clearly outlined in the legal agreements and operating documents of the syndication.

How Can Investors Evaluate the Financial Reports Related to the Investment?

Investors can evaluate the financial reports related to the investment by carefully reviewing and analyzing the provided documents. They should assess the property’s historical financial performance, including income, expenses, and cash flow. It is essential to verify the accuracy and completeness of the financial statements, ensuring they have been prepared by qualified professionals. Investors should also compare the financial projections with market trends and consider potential risks that may impact the investment’s financial performance. Seeking advice from financial experts or consultants can also be beneficial in evaluating the financial reports.

What Are the Potential Risks and Benefits of Syndication?

Real estate syndication presents both risks and benefits. Some potential risks include market fluctuations, economic uncertainties, unexpected property expenses, and changes in regulations. Investors should also consider the potential illiquidity of their investment, as real estate is typically a long-term commitment. On the other hand, syndication offers benefits such as reduced risk through diversification, increased potential return through shared investment, access to professional management, and the opportunity to participate in larger real estate projects that may not be feasible individually. It is essential for investors to carefully weigh these risks and benefits before making any syndication investment decision.

What Steps Should Investors Take to Ensure They Are Making Informed Decisions?

To ensure they are making informed decisions, investors should take several steps. First, they should thoroughly review all the available documentation provided by the syndicator, including the offering memorandum, financial reports, and legal agreements. Additionally, investors should conduct their own due diligence, which may involve inspecting the property, researching the local market, and seeking advice from professionals such as lawyers or financial advisors. It is important to ask questions and seek clarification on any aspects that are not clear or require further information.

What Kind of Information Should Investors Gather Before Making a Syndication Decision?

Investors should gather information about the syndication opportunity before making a decision. This includes conducting research on the property, such as its location, market conditions, and potential for growth or appreciation. They should also evaluate the track record and experience of the syndicator, including their past performance with similar projects. Additionally, investors should review the provided financial projections, property reports, and any legal or regulatory documents related to the investment.

How to Manage Your Syndication With Groundbreaker

At this point, you should have a good understanding of real estate syndication and the steps involved in syndicating a property. But what about after the deal is closed? How do you manage your syndicate?

This is where Groundbreaker comes in.

Groundbreaker is an investment management platform that helps real estate professionals streamline the syndication process.

With Groundbreaker, you can:

- List your real estate investment opportunity on our platform and connect with potential investors worldwide.

- Communicate with your syndicate partners, track progress on the project, and manage financials.

- Manage your crowdfunding efforts and track your progress with ease.

- Automate your investor reporting and stay compliant with SEC regulations.

- Manage your investors and their investment information.

- Create and send investor reports.

- Collect and track investment payments.

And much more.

Whether you’re just getting started in real estate syndication or you’re a seasoned pro, Groundbreaker can improve how you manage real estate investments.

To see for yourself, why don’t you schedule a free Groundbreaker demo? It’s the best way to see how our platform can help you reach your investment goals.