Are you thinking about investing in multifamily properties?

If so, you’re in good company.

Multifamily investments are a great way to build wealth and generate passive income. But if you’re new to the game, it can be tough to know where to start.

Today, we’ll walk you through everything you need to know about multifamily investing. Whether you’re just getting started or you’ve been syndicating multifamily properties for years, this guide has something for you.

Let’s start with the basics.

What Is Multifamily Investing?

Multifamily investing is the process of buying and owning a property that contains multiple units, usually apartments. As the owner of a multifamily property, you collect rent from each of the units in the building.

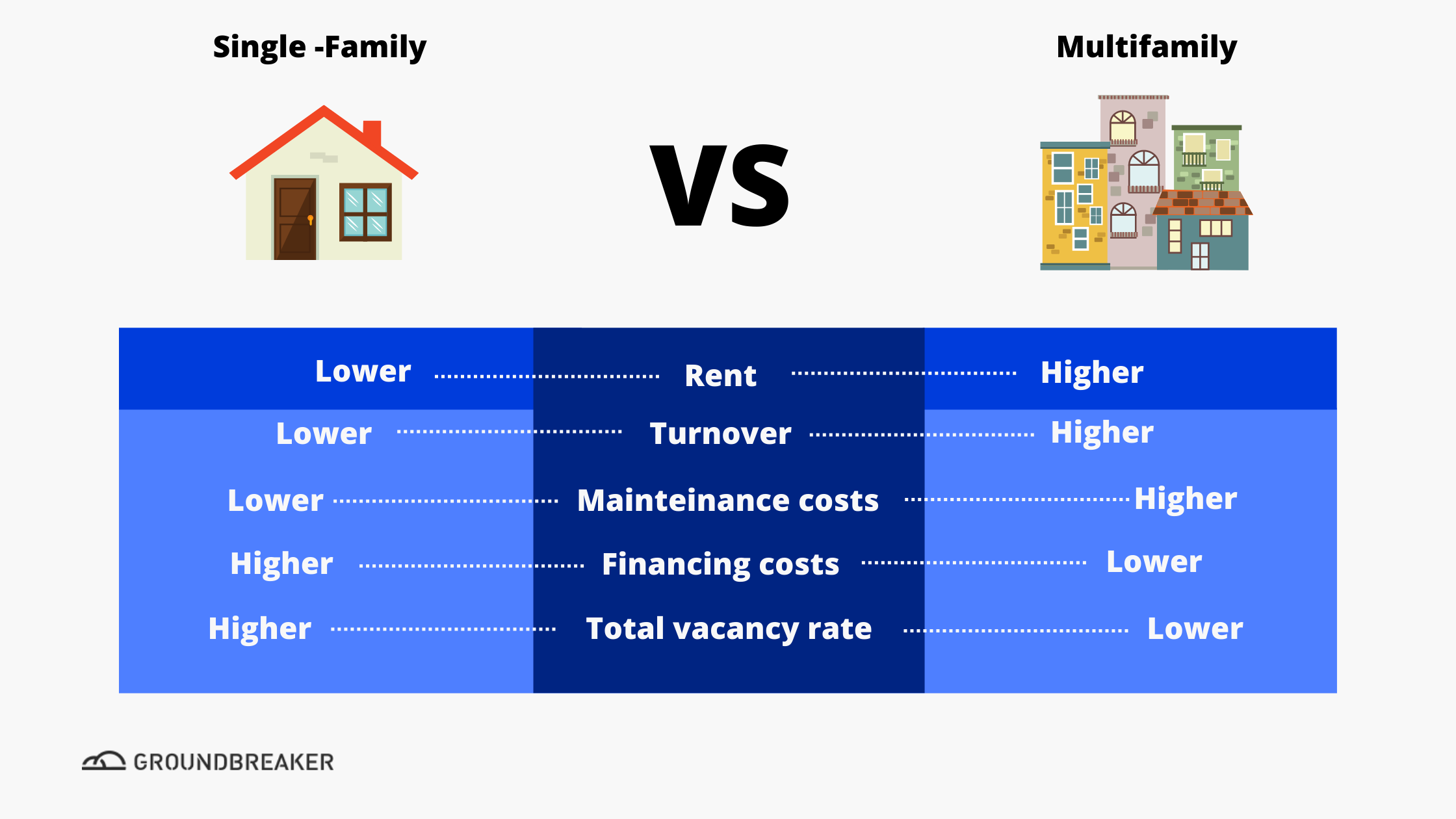

This process is different from single-family investing, where you would only own and rent out a single home. The critical distinction is that multifamily properties are designed to be occupied by more than one family.

Investors can either own the property outright or purchase a share in a larger multifamily investment vehicle (like a real estate syndicate).

Why Should You Invest in Multifamily Properties?

There are a few key reasons why multifamily properties are such a popular investment. Some of the most critical include:

- Cash flow: With a multifamily property, you’ll collect rental income every month. This predictable source of cash flow can help you pay down debt and build wealth over time.

- Appreciation potential: Multifamily properties tend to appreciate more than single-family homes. This means that you can earn a higher return on your investment when you eventually sell the property.

- Economies of scale: It’s often cheaper to operate a multifamily property than to operate multiple single-family homes. This is because you can save on costs like marketing and maintenance.

- Financeability: Multifamily properties are generally easier to finance than other types of investment property. Lenders tend to see them as a lower-risk investment, so you may be able to get better loan terms.

What Is the Downside of Multifamily Investing?

Of course, no investment is without risk. When you’re considering a multifamily asset, it’s essential to be aware of the potential downside, including:

- Higher turnover: Because multifamily properties have multiple units, you’re likely to experience higher turnover than you would with a single-family home. This can be a challenge if you’re trying to keep vacancy rates low.

- Management risk: If you don’t have a good property manager, keeping multiple tenants happy and your property in good condition can be difficult.

- Leverage risk: If you use leverage to finance your multifamily property, you may owe more than the property is worth if the value decreases.

- Higher initial investment: Multifamily properties generally require a more significant upfront investment than single-family homes. This can make them less accessible to some investors.

How To Use Syndications To Invest in Multifamily Real Estate

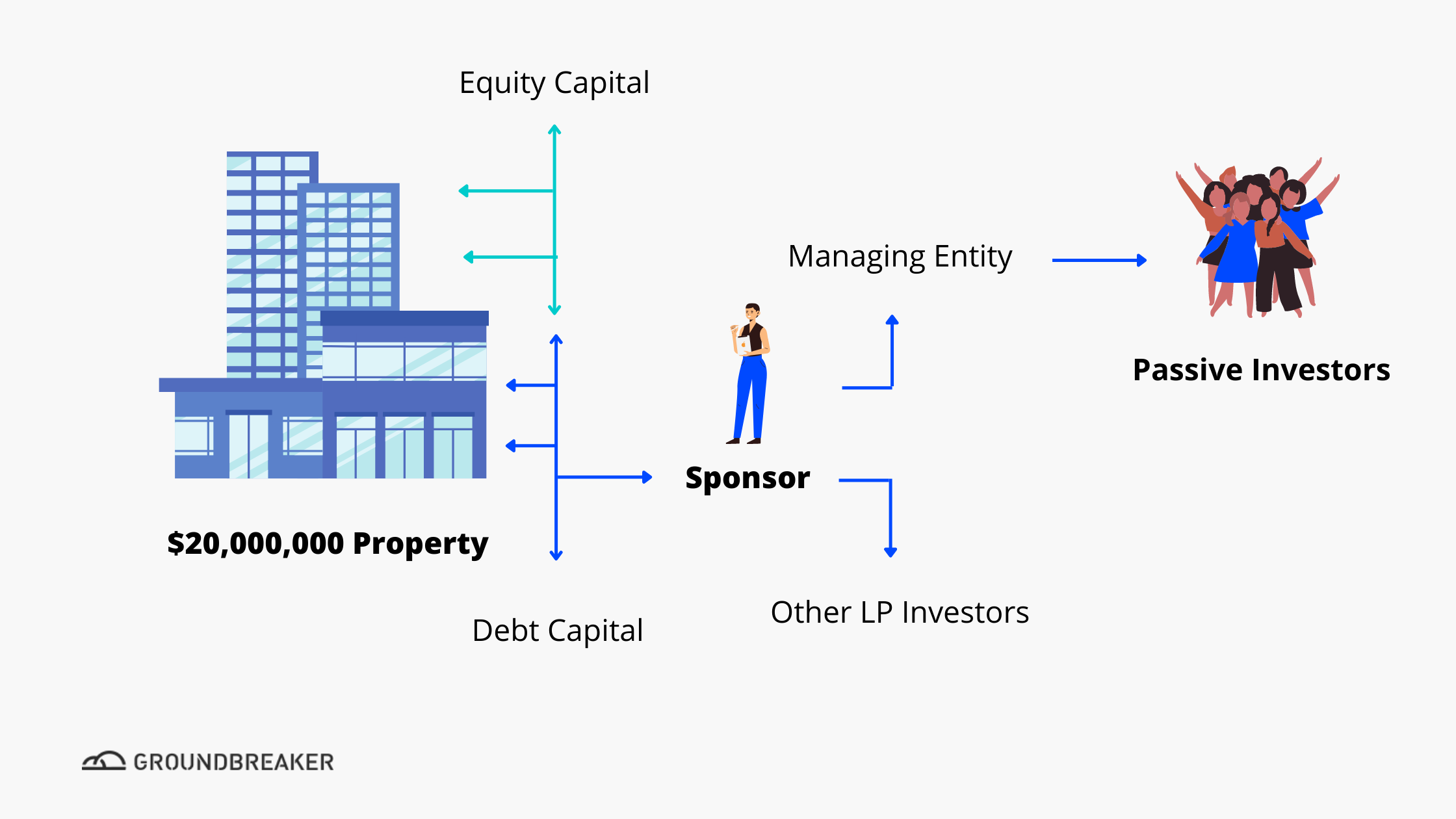

A real estate syndicate is an investment vehicle that allows multiple investors to pool their money together to purchase a property.

For example, let’s say you find a 200-unit apartment building that you’d like to purchase for $20 million. You could put up the entire $20 million yourself, but that might not be possible or desirable.

Instead, you could form a syndicate and raise the money from other investors.

Let’s say you find 100 investors who are willing to contribute $200,000 each. Now you have the $20 million you need to purchase the rental property.

As the syndicator, you will typically put up a small amount of your own money (usually around 10-20%) and act as the general partner. The investors will be limited partners and will provide the bulk of the capital.

The limited partners will usually have a passive role. They won’t be involved in the day-to-day management of the apartment complex.

This structure can be a great way to raise the capital you need to purchase a multifamily property. It also allows you to spread the risk across multiple investors.

Before you start multifamily syndication, it’s essential to do your due diligence. Some of the major best practices include:

1. Find the Right Property

The first step is to find a multifamily property that meets your investment criteria.

You’ll want to consider factors like the location and the potential for rent growth.

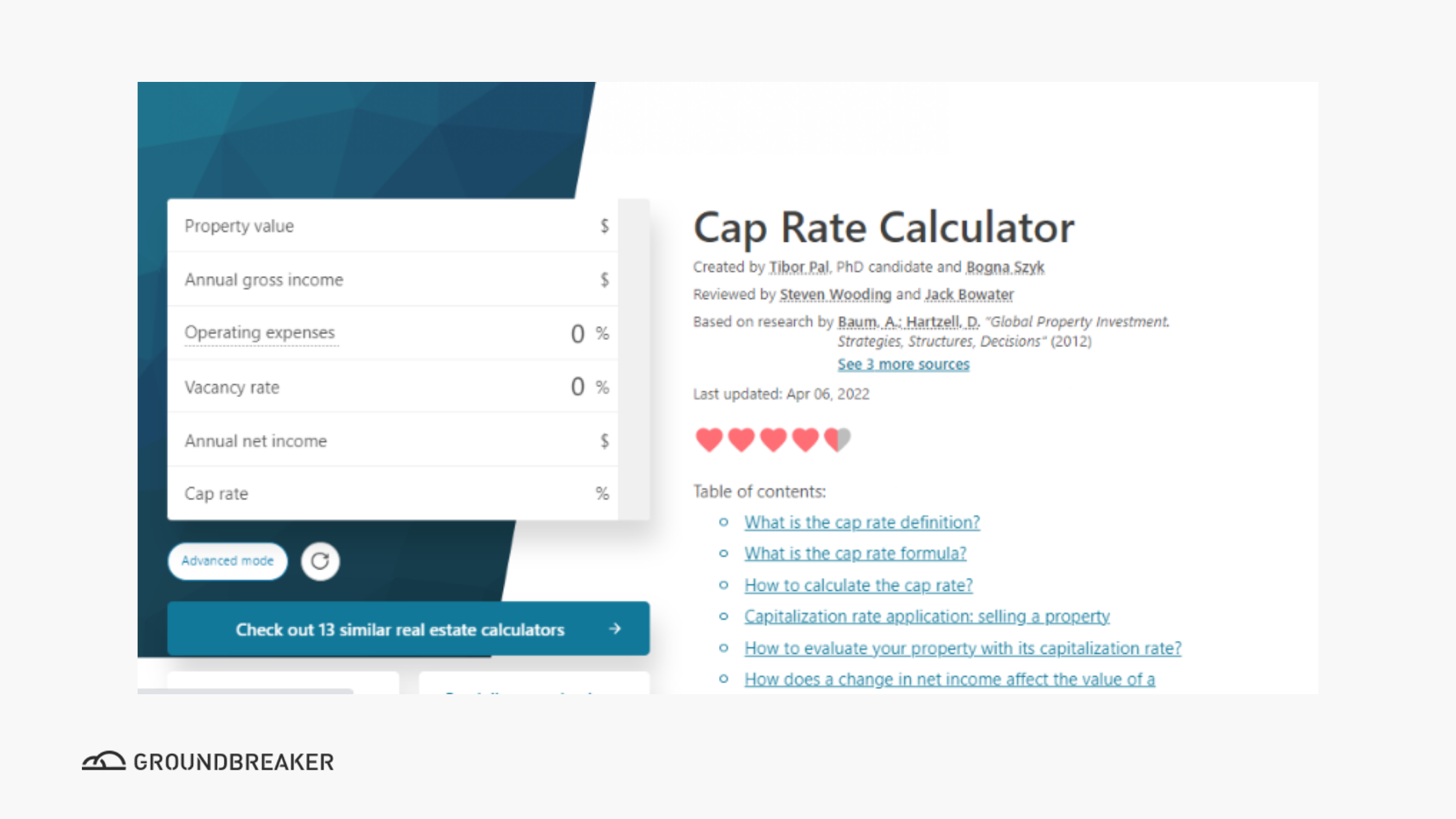

It’s also vital to make sure the rental property is reasonably priced. You can use a tool like the Cap Rate Calculator to help you determine whether the price is fair.

Besides, you should also take a look at the local market conditions. Is the area growing? What is the vacancy rate?

These factors will all play a role in your decision-making process.

2. Conduct Due Diligence

Once you’ve found a multifamily building you’re interested in, it’s time to do your due diligence.

Investigate the property to ensure that it’s a good investment opportunity.

You’ll want to look at things like the financial statements, the lease agreement, and the property’s condition.

It’s also important to talk to the current owner and property manager to get their insights.

You can even talk to other investors who have experience with apartment properties.

This due diligence process is critical to your success as a syndicator. Otherwise, you could end up making a bad investment.

If this is your first time syndicating a property, you may want to consider working with an experienced partner. This can help you navigate the process and avoid any potential pitfalls.

3. Put Together a Syndicate

Once you’ve done your due diligence and you’re ready to move forward, it’s time to put together your syndicate.

This is the group of investors who will provide the capital for your investment.

You’ll want to take some time to put together a group of high-quality investors. This usually includes people like family, friends, and co-workers.

You can also reach out to your network of contacts to see if anyone is interested in investing.

It’s also a good idea to work with a placement agent to help you raise capital.

A placement agent is a professional who specializes in raising money for real estate investing.

They can help you reach a wider group of potential multifamily investors and close deals more quickly.

4. Use the Right Syndication Platform

Real estate syndication software can make it easier to manage your investment.

This type of software allows you to track your progress, communicate with your investors, and keep all of your documents in one place.

It can also help you automate some of the tedious tasks associated with syndication, like sending out monthly reports.

There are several different software platforms to choose from, so it’s crucial to find one that meets your needs.

With Groundbreaker, for example, you get access to everything you need to syndicate a real estate investment, all in one place.

From deal management to investor communication, Groundbreaker has you covered. Some of our most vital features include:

- Fundraising management: With Groundbreaker, you can manage your entire fundraising process online. This includes sending out deal memos, tracking investor commitments, and managing the closing process.

- Investor communications: Groundbreaker makes it easy to keep your investors up-to-date on your progress. With our built-in investor portal, you can share updates, reports, and documents with your investors 24/7.

- Document management: Managing all of your syndication documents can be a challenge. But with Groundbreaker, you can store all of your documents in one secure place.

- CRM: Our CRM tool allows you to track your interactions with potential and current investors. This includes phone calls, emails, and meetings.

You can get a more thorough understanding of Groundbreaker by reading our product overview page.

5. Review Your Documents

Once you’ve put together your syndicate, it’s time to review your documents.

This includes your syndication agreement, operating agreement, and subscription agreement.

These documents outline the rights and responsibilities of each party involved in the syndication.

It’s important to ensure that these agreements are fair and protect your interests.

You should also have a lawyer review your documents to ensure everything is in order.

6. Close the Deal

At this point, you’re ready to close the deal and start syndicating your investment.

The closing process can be a bit complicated, so it’s important to understand the steps involved.

You’ll need to coordinate with your title company, escrow company, and lawyers to make sure everything goes smoothly.

Once the deal is closed, you’ll be ready to start operating your syndication.

7. Manage Your Syndication

After you’ve closed the deal and started your syndication, it’s time to manage your investment.

This includes collecting rent, paying bills, and maintaining the property.

You’ll also need to communicate with your investors regularly. This includes sending out monthly reports and updating them on your progress.

This is where syndication software makes things easier.

Having an investor portal where you can post updates and documents is a huge time-saver. Besides, your investors will appreciate having a central place to stay up-to-date on your progress.

8. Grow Your Investment Portfolio

Of course, this step is optional. But if you’re looking to grow your investment portfolio, syndicating is a great way to do it.

With each successful syndication, you’ll gain more experience and build a better reputation.

This will make it easier to raise capital for future deals. And as you syndicate more deals, you’ll be able to grow your portfolio quickly.

Multifamily Investing FAQs

Below are some of the most frequently asked questions about multifamily syndication.

What Are Multifamily Investments?

Multifamily investments are real estate properties that have more than one unit. This can include apartments, duplexes, triplexes, and quads.

Is Multifamily Real Estate a Good Investment?

Even though any investment brings risks, multifamily assets can be a great way to generate passive income and build wealth over time.

Of course, you must do your due diligence to ensure that the property is a good fit for your real estate investing goals.

How Do I Start Multifamily Investing?

The best way to get started in multifamily investing is to start small. You can begin by investing in a duplex or triplex and then move to larger properties as you gain experience.

Real estate syndications also offer a great way to start multifamily investing. With syndications, you can pool your money with other investors to purchase more expensive properties.

The Bottom Line

If you’re looking for a way to generate passive income and build wealth over time, multifamily investing may be a good option.

There are many different ways to get started in multifamily investing. Still, one of the best ways is to syndicate a property.

If you’re looking for a platform to start and manage your multifamily syndication, schedule a free Groundbreaker demo today. We offer an all-in-one solution to help you with everything from marketing to close.